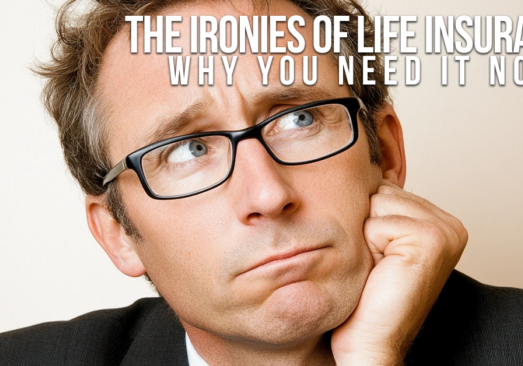

Life Insurance Claims: Demystifying the Process (So You Can Get What You’re Owed)

Life Insurance Claims: Demystifying the Process (So You Can Get What You’re Owed)

Life insurance is meant to offer financial security during a difficult time. But when it comes to actually filing a claim, the process can seem daunting. Fear not! While life insurance claims involve significant sums of money, and companies need to be thorough, the process itself is generally straightforward. Here’s a breakdown to help you navigate this essential step:

Step 1: Gather Your Forces (Policy, Agent, and Death Certificate)

First things first – you’ll need a few key items. Locate the life insurance policy itself (the company name is usually prominent on the document). If you have the agent’s business card attached, that’s a bonus. If not, no worries – any representative from the insurance company can help you. Contact them to inquire about their specific claims procedures.

Next, you’ll need a certified copy of the insured’s death certificate. This can typically be obtained from the funeral director. Tip: If you’re the executor of the estate, consider requesting multiple copies – they often come in handy for various purposes.

Step 2: Paper Power: Filling Out the Claim Forms

The insurance company will likely send you claim forms, either by mail, through your agent, or online. Fill them out completely and accurately, following all instructions carefully. Once you’re done, gather the completed forms along with the certified death certificate and send them back to the company (via your agent or by mail, depending on their preference).

Step 3: Choosing Your Payday Preference

Insurance companies typically offer various payout options. Decide how you’d like to receive the claim proceeds (lump sum, installments, etc.). Once you’ve made your selection, it’s simply a waiting game.

Step 4: Timeline and Support: How Long Does It Take?

By law (depending on your state), insurance companies generally have 30 days to review your claim. During this time, they may:

- Approve the claim and issue payment based on your chosen payout method.

- Request additional information to verify details.

- Deny the claim (although this is uncommon).

Here’s where our independent insurance agents can be invaluable. They’re available to assist you throughout the claims process, answer your questions, and advocate on your behalf if necessary.

We Understand

Losing a loved one is a deeply emotional experience. Filing a life insurance claim shouldn’t add to your stress. By following these simple steps and having the right support system in place, you can ensure a smoother and more efficient process during a difficult time.

Do You Have Questions About Life Insurance?

If you have questions about life insurance claims, existing policies, or are considering a review and quote, please don’t hesitate to contact us. We’re here to help you navigate the complexities of life insurance and ensure your loved ones are protected.

Contact Us

OUR LOCATION

2010 Crow Canyon Place, Suite 100 San Ramon, CA 94583

1-925-683-9743

CA License #0B30027

© Copyright 2024 Michael Smith Insurance Solutions | All Rights Reserved

Site by ICA Agency Alliance

2010 Crow Canyon Place, Suite 100 San Ramon, CA 94583

1-925-683-9743

CA License #0B30027

© Copyright 2024 Michael Smith Insurance Solutions | All Rights Reserved

Site by ICA Agency Alliance